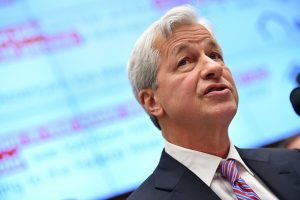

![]() Jamie Dimon is optimistic on the U.S. economy in the around foreseeable future, and the JPMorgan Chase chairman and CEO is urging corporate leaders to play a more energetic position in shaping general public policy.

Jamie Dimon is optimistic on the U.S. economy in the around foreseeable future, and the JPMorgan Chase chairman and CEO is urging corporate leaders to play a more energetic position in shaping general public policy.

In his annual letter to shareholders, Dimon gave a thumbs-up to the instances shaping the socioeconomic surroundings.

“I have small doubt that with excessive discounts, new stimulus discounts, large deficit shelling out, more QE, a new possible infrastructure invoice, a profitable vaccine, and euphoria around the conclude of the pandemic, the U.S. economy will possible increase,” Dimon stated.

“This increase could very easily run into 2023 mainly because all the shelling out could prolong nicely into 2023.”

But Dimon also warned that any increase are unable to be sustained devoid of important self-discipline from the federal government.

But Dimon also warned that any increase are unable to be sustained devoid of important self-discipline from the federal government.

“The long-lasting impact of this increase will be absolutely known only when we see the high-quality, success, and sustainability of the infrastructure and other government investments,” he stated.

On The Evolution Of Fiscal Products and services: Dimon warned “banks are participating in an more and more smaller position in the financial process,” which he blamed on a blend of elements which include onerous regulations and growing opposition from nonbank loan companies, fintechs, and retail and engineering organizations that are permeating the financial solutions sector with banking items.

The opposition does not have the identical regulatory compliance necessities that banking companies face, Dimon stated, introducing that this could result in new challenges that are not currently being resolved by regulators.

As for his establishment, Dimon stated he is continue to targeted on developing a new headquarters in New York that will accommodate twelve,000 to fourteen,000 personnel, and he dropped a not-subtle clue that he has a buying checklist and is ready to go buying.

“We have outlined that our highest and ideal use of cash is to grow our businesses, and we would want to make fantastic acquisitions in its place of buying back inventory,” he stated.

“Acquisitions are in our foreseeable future, and fintech is an place the place some of that cash could be put to operate — this could include things like payments, asset management, information, and relevant items and solutions.”

On The Private Sector And Politics: Dimon acknowledged that the U.S. arrived out of 2020 battered and bruised from acute worries ranging from the COVID-19 pandemic and the economic tumult it made, the unrest right after the loss of life of George Floyd in Minneapolis police custody, and the divisive presidential election.

As a result of these challenges, Dimon stated the general public mood has turned sour and distrustful.

“Many Americans have missing faith in their government’s skill to remedy these and other problems — in truth, most individuals would describe government as ineffective, bureaucratic, and generally biased,” he stated

“Almost all establishments — governments, faculties, media, and businesses — have missing reliability in the eyes of the general public. And probably for great cause: Quite a few of our problems have been around for a prolonged time and are not aging nicely. Politics is more and more divisive, and government is more and more dysfunctional, primary to a number of insurance policies that merely really don’t operate.”

Even though Dimon stated “people are proper to be indignant and really feel let down,” he warned against anti-government sentiment.

“Our failures gas the populism on both the political still left and proper,” he stated. “But populism is not policy, and we are unable to let it push a different spherical of weak preparing and undesirable management that will merely make our country’s condition worse.”

Dimon termed on his fellow corporate leaders in getting to be more vocal in addressing social and political challenges, insisting that executives “should not be buttonholed by the discussion about whether or not there are ‘fiduciary’ factors to feel of ‘shareholder value’ narrowly and to the exclusion of people who operate at the corporation, our clients, and communities.”

He also insisted the non-public sector could play a position in resolving the problems bedeviling government leaders.

“JPMorgan Chase requires an energetic position in large-scale general public policy challenges,” he stated.

“We are absolutely engaged in striving to remedy some of the world’s major challenges — weather change, poverty, economic improvement, and racial inequality — and the accompanying capabilities that adhere to describe the comprehensive endeavours we are creating. With nicely-built insurance policies, we feel these problems can all be solved.”

This story originally appeared on Benzinga. © 2021 Benzinga.com.

Benzinga does not deliver investment tips. All rights reserved.

More Stories

Forming Great Internet Business Ideas

An Internet Home Based Opportunity in Online Marketing

Seven Common Causes of Business Failure